At the “1999 Stock Plan” or the “Stock Plan”).

The Board of Directors of the Company has adopted a written charter for the Compensation Committee, which is available on the Corporate Governance page in the Investor Relations section of the Company’s website, www.balchem.com. The current members of the Compensation Committee are Dr. Televantos (Chair) and Messrs. Fischer and McMillan, each of whom is independent, as such term is defined under the NASDAQ Marketplace Rules.

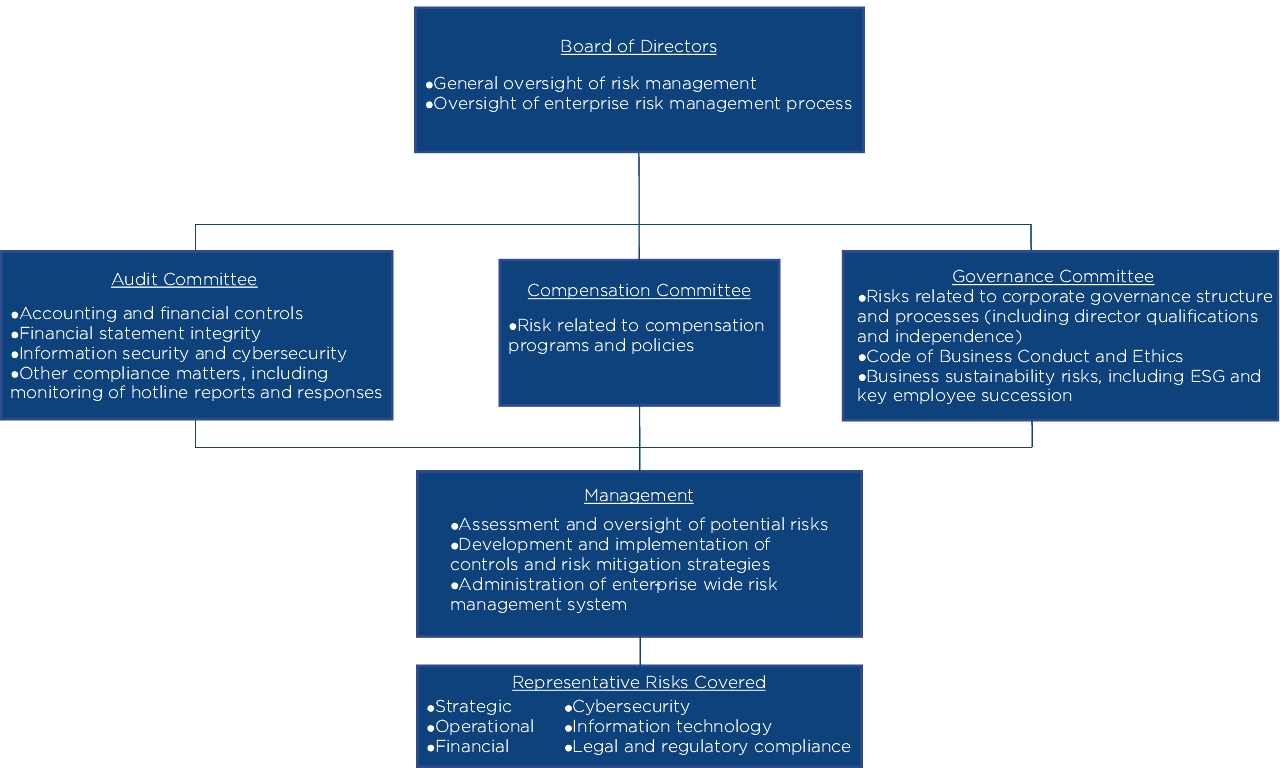

Corporate Governance and Nominating Committee. The duties of the Corporate Governance and Nominating Committee are, among other things, to (i) consider and make recommendations to the Board concerning the appropriate size, function and needsdirection of the Board, (ii) determinewe have instituted an enterprise-wide risk management process that identifies potential exposure to risks that arise in the criteriacourse of our business. The Board uses our enterprise-wide risk management system as a key tool for Board membership, oversee searches and evaluate and recommend candidates for election tounderstanding the Board, (iii) evaluate and recommend to the Board responsibilities of the Board committees, (iv) annually review and assess the adequacy of the Company’s Corporate Governance Guidelines and recommend any changes to the Board for adoption, (v) annually evaluate its own performancerisks facing us as well as oversee an annual self-evaluationassessing whether management's processes, procedures and practices for mitigating those risks are effective. Our Internal Audit function is primarily responsible for the planning, assessment and reporting of our risk profile and this risk management system.

While most risk oversight activities are administered through the Board and otherAudit Committee, each of our Board Committees (vi) oversee compliance with the Company’s Stock Ownership Policies, (vii) consider mattershas historically focused and continues to focus on specific risks within its respective area of corporate social responsibility and corporate public affairs related to the Company’s employees and stockholders, (viii) recruit and evaluate new candidates for nomination by the full Board for election as directors, (ix) prepare and update an orientation program for new directors, (x) evaluate the performance of current directors in connection with the expiration of their term in office providing adviceregularly reports to the full Board as to nomination for reelection, and (xi) annually review and recommend policies on director retirement age.

The Board of Directors of the Company has adopted a written charter for the Corporate Governance and Nominating Committee, which is available on the Corporate Governance page in the Investor Relations section of the Company’s website, www.balchem.com. The current members of the Corporate Governance and Nominating Committee are Messrs. McMillan (Chair), Premdas and Coombs and Wineinger, each of whom is independent, as such term is defined under the NASDAQ Marketplace Rules.

Executive Committee. The Executive Committee is authorized to exercise all the powers of the Board of Directors in the interim between meetings of the Board, subject to the limitations imposed by Maryland law. The Executive Committee is also responsible for: (i) the recruitment, evaluation and selection of suitable candidates for the position of CEO, for approval by the full Board; (ii) the preparation, together with the Compensation Committee, of objective criteria for the evaluation of the performance of the CEO; and (iii) reviewing the CEO’s plan of succession for key executives of the Company. The current members of the Executive Committee are Dr. Televantos (Chair), Mr. Fischer and Mr. McMillan.

Nominations of Directors

The Corporate Governance and Nominating Committee considers re-nominating incumbent directors who continue to satisfy the Company’s criteria for membership on the Board; whom the Board believes will continue to make contributions to the Board; and who consent to continue their service on the Board. If the incumbent directors are not nominated for re-election or if there is otherwise a vacancy on the Board, the Corporate Governance and Nominating Committee will solicit recommendations for nominees from persons that they believe are likely to be familiar with qualified candidates, including Board members and members of management. The Corporate Governance and Nominating Committee may also determine to engage a professional search firm to assist in identifying qualified candidates. The Corporate Governance and Nominating Committee also considers independent director candidates recommended by one or more substantial, long-term stockholders. Generally, stockholders who individually or as a group hold 5% or more of the Company’s common stock and have continued to do so for over one year will be considered substantial, long-term stockholders. In order to be considered by the Corporate Governance and Nominating Committee, the names of such nominees, accompanied by relevant biographical information, must be properly submitted, in writing, to the Secretary of the Company by the deadline for including shareholder proposals in the Company’s proxy materials as set forth below in “Stockholder Proposals for 2017 Annual Meeting.” Stockholder nominations that comply with these procedures and that meet the criteria outlined above will receive the same consideration that other candidates receive.

The Corporate Governance and Nominating Committee and the Board have adopted guidelines for identifying or evaluating nominees for directors, including incumbent directors and nominees recommended by stockholders. The Company’s current policy is to require that a majority of the Board of Directors be independent; at least four of the directors have the financial literacy necessary for service on the audit committee and at least one of these directors qualifies as an audit committee financial expert. In addition, directors may not serve on the boards of more than three other public companies without the approval of the Board of Directors and directors must satisfy the Company’s age limit policy for directors, which require that a director retire at the conclusion of his or her term in which he or she reaches the age of 70. The guidelines for nomination for a position on the Board of Directors provide for the selection of nominees based on the nominee’s skills, achievements and knowledge, and also contemplate that the following will be considered, among other things, in selecting nominees: experience and skills in areas critical to understanding the Company and its business; personal characteristics, such as integrity and judgment; and the candidate’s ability to commit to the Board of Directors of the Company. Members of the Corporate Governance and Nominating Committee (and/or the Board) also meet personally with each nominee to evaluate the candidate’s ability to work effectively with other members of the Board, while also exercising independent judgment. Although the Board does not have a formal diversity policy, the Board endeavors to comprise itself of members with a broad mix of professional and personal backgrounds. Further, in considering nominations, the Governance and Nominating Committee takes into account how a candidate’s professional background would fit into the mix of experiences represented by the then-current Board.

Lead Director

The Board of Directors has had a Lead Director since 2005. Dr. Televantos has been the Lead Director since August 2010. The Lead Director functions, in general, to reinforce the independence of the Board of Directors of the Company, and is appointed on a rotating basis from the independent directors. The Lead Director serves at the pleasure of the Board and, in any event, only so long as that person shall be an independent director of the Company. The Corporate Governance and Nominating Committee reviews annually the functions of the Lead Director and recommends to the Board any changes that it considers appropriate. The Lead Director provides a source of Board leadership complementary to that of the Chairman of the Board. The Lead Director is responsible for, among other things, (i) working with the Chairman and other directors to set agendas for Board meetings; (ii) providing leadership in times of crisis together with the Executive Committee; (iii) reviewing the individual performance of each of the directors with the Chair of the Corporate Governance and Nominating Committee; (iv) chairing regular meetings of independent Board members without management present (executive sessions); (v) acting as liaison between the independent directors and the Chairman; and (vi) chairing Board meetings when the Chairman is not in attendance.

Board Role in Risk Oversight

While our Board provides direct risk oversight, the Company is transitioning from risk oversight through the Audit and Governance Committees to primary risk oversight through the Audit Committee. The Board and the Audit Committee has and will regularly discuss with management ourthe Company’s major risk exposures with management, their potential financial impact on the Company and the management thereof. In particular, the Audit Committee receives, or arranges for the Board of Directors to receive, periodic reports from management on areas of material risk to the Company, including financial, operational, legal, regulatory and strategic risks. The Company has initiated an enterprise risk management effort led by its Internal Audit function. The Company does not have a chief risk officer; therefore, the Audit Committee receives these reports from the member of management tasked with the responsibility to understand, manage and mitigate the particular risks. The Chairman of the Audit Committee reports on the discussion to the full Board during the Committee reports portion of the next Board meeting, which enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to cross-discipline risks and interrelated risks. The Company believes that our Board leadership structure (separate Chairman of the Board and Chief Executive Officer) optimizes risk oversight.

(1)

| The Audit Committee receives, or arranges for the Board to receive, on a no less than annual basis, reports from management on areas of material risk to the Company, including financial, operational, legal, regulatory, information security and cybersecurity and strategic risks (the “Company Risk Reports”). |

(2)

| The Audit Committee receives the Company Risk Reports from members of management tasked with the responsibility to understand, manage and mitigate the risks (with the Company’s enterprise risk management effort being facilitated by its Internal Audit function). |

(3)

| The Chair of the Audit Committee reports on its discussion of the Company Risk Reports to the full Board during the Committee reports portion of the Board meeting following the receipt of said Company Risk Reports, which enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to cross-discipline risks and interrelated risks. |

The Compensation Committee also evaluates risk, as such relates to our compensation program. Please refer to the discussion in the Compensation Discussion and Analysis under the section “Risk Considerations in our Compensation Program”.Program.”

As part of its role in evaluating the Company’s corporate governance practices and procedures, including identifying best practices and reviewing and recommending to the Board for approval any changes to the documents, policies and procedures in the Company's corporate governance framework, including its Articles of Incorporation and Bylaws, the Governance Committee evaluates the risks associated it with these practices and procedures.

Additionally, the Governance Committee plays a critical role in mitigating the risks associated with key employee departures via its role in succession planning for the Chief Executive Officer (“CEO”) and other executives. At least once per year, usually as part of the annual talent review process, the Governance Committee and the Board discuss and review the succession plans for the CEO and other key executives. The Board also becomes familiar with potential successors via various means, including annual talent reviews, presentations to the Board, and communications outside of meetings. Our succession planning process is an organization-wide practice designed to proactively identify, develop and retain the leadership talent that is critical for our future business success.